#Excel budget template family of 5 how to#

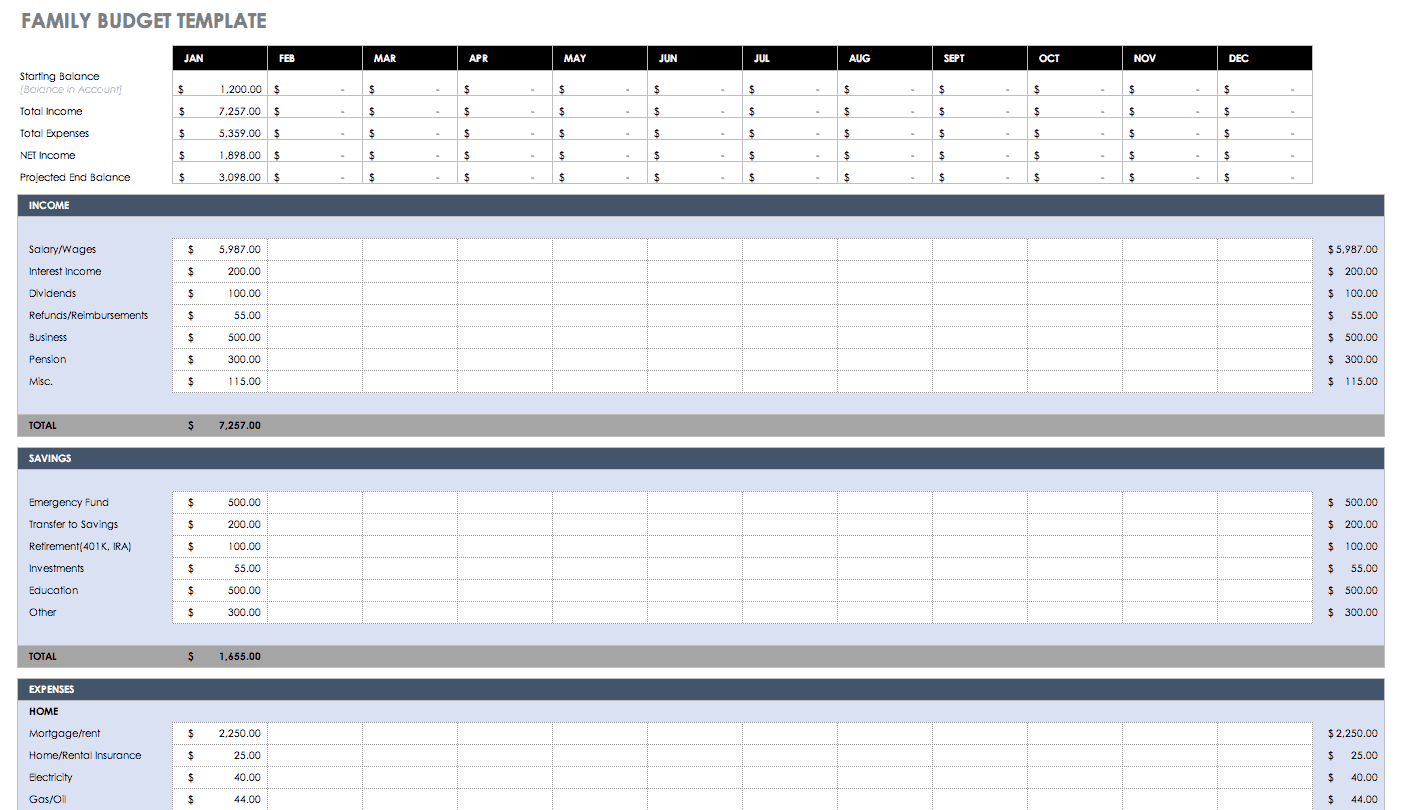

See our articles How to Make a Budget and 5 Basic Budgeting Tips if you are just getting started or new to budgeting. The help worksheet is much more detailed now. To use the budget effectively, match your bill due dates to one of the two paychecks you receive monthly to stay on track. This budget can help you manage your money well if you get paid every other week. It is a well-organized spreadsheet designed for you to work with easily. Smartsheet offers many budgeting templates, including a bi-weekly budget. Ideally, you obtain a personal budget template excel form with the monthly budget statement to know your monthly electricity and water services expenses. Percentages below the category totals show you what percent of the total family budget is going to that category. To make budgeting easier for you and your spouse, family or household, weve created an intelligent, interactive Canadian budget calculator spreadsheet in Excel. 4.Financial Monthly Budget Statement Template. New in Version 2.0: The new graphs show your spending and savings balance over time. If you are moving or buying a home, you can analyze your budget to see where you may need to cut back to be able to afford an increase in rent or a higher mortgage. Monthly Budget Template Family Planner Excel Edit in Excel Budget Planner for Family Budget for Month in Excel Instant Download. For example, if you are changing jobs, you can use the planner to estimate whether the increase (or decrease) in pay will still allow you to make ends meet. You’ll be able to easily set up a budget with Mint based on your spending patterns.

#Excel budget template family of 5 free#

And the best part is that it is completely free Image from Mint. Mint (App) Mint offers budgeting assistance to help you manage your budget on the go.

This free family budget planner worksheet will help you create a yearly budget by entering amounts based on the month in which expenses are incurred.īy creating a yearly budget, you can more easily predict how major life changes will affect your finances. That will give you an idea of whether or not you stuck to your budgeting goals.

0 kommentar(er)

0 kommentar(er)